18+ Equitable mortgage

It is more expensive than equitable mortgage. Stamp Duty costs 01 or 02 of home value.

2

Sean Campbell 614 764-1232.

. Bring us your vision. To ensure the best experience please confirm that your dentist is participating in the Equitable Dental Network andor your vision professional is participating in the VSP Choice network when you make your appointment. While at first glance the difference between equitable and registered mortgages simply includes third-party interference they target different kinds of borrowers budgets and risk appetites.

It should reflect your personal goals and help you reach them on your own terms. 5 Crucial Points to Consider. Oliverez and Robles vs Sarmiento GR No.

Equitable Mortgage Group was founded on the vision and promise to provide you with a fast comfortable and competitively-priced mortgage experience. It is less expensive than a registered mortgage in terms of affordability. Aug 18 2022 Updated Aug 18 2022 357pm EDT.

Zach Appleby 614 602-8429. A mortgage under which the mortgagee does not obtain a legal interest in the land. An equitable mortgage is one which although lacking in some formality or form or words or other requisites demanded by a statute nevertheless reveals the intention of the parties to charge real property as security for a debt and contains nothing impossible or contrary to law.

In registered mortgage a borrower have to approach the sub registrars office. All information contained herein is for informational purposes only and while every. Adam Bracken 330 466-4140.

Well provide the plan. For example a mortgage granted by a beneficiary under a trust of land could only be equitable2 An equitable mortgage will arise if the mortgage is not. In a registered mortgage a borrower must contact the Office of the Sub-registrar.

18 Equitable Mortgage - Read online for free. It is more costly than an equitable mortgage. Under the equitable mortgage there is no legal binding over the loan agreement and is simply based on the mutual agreement of the parties involved.

Ad Weve Researched Lenders To Help You Find The Best One For You. An equitable mortgage may arise as follows1 If the mortgagor has only an equitable interest in the land he can only grant an equitable mortgage. Equitable Mortgage Corp which launched out of a 500-square-foot suite in 1995 before expanding in the years since will relocate from 3530.

For example some people are not comfortable with their lenders owning their property. Not easy on the pocket. In Equitable Mortgage you have to buy a stamp paper.

Its 5 of the home value. Stamp Duty costs 01 or 02 of home value. 11 hours agoA 20-year fixed-rate mortgage refinance of 100000 with todays interest rate of 618 will cost 727 per month in principal and interest.

May the property subject of the apparent sale be reconveyed to the seller upon finding by the court that the transaction is one of equitable mortgage. Equitable Mortgage Corporation Loan Officers. Essential Differences Between Equitable and Registered Mortgage.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. You have to buy stamp paper in Equitable Mortgage. Up to 3 cash back CASE DIGEST NO.

The bank can do anything they wish to with the property. Recovery of Real or Personal Property Damages etc. Tony Butler 614 764-5071.

Ad Top Home Loans. These questions were answered in the fairly recent case of. 1 day agoThe negative trends have developed during a recent spike in mortgage rates as the Federal Reserve tightens monetary policy.

A 30-year fixed-rate mortgage had a 566 rate as of last week up. Taxes and fees are not included. A smart plan for the future considers your needs and lifestyle today as well as your long-term aspirations.

Our simple business philosophy is to put your interests first. Log in for convenient access to patient information. Over the life of the.

The deposit of title-deeds by the owner of an estate with a person from whom he has borrowed money with an accompanying agreement to execute a regular mortgage or by the mere deposit without even any verbal agreement respecting a regular security. It is less expensive than registered mortgage. Steven Calabrese 239 778-6548.

Bruce Calabrese 614 582-0037. Published 7 January 2022 The Daily Tribune When is a transaction denominated as a sale agreement an equitable mortgage. Its 5 of the home value.

Equitable mortgages are not registered. 2021 American Pacific Mortgage Corporation. Not one for the books.

A registered mortgage is registered. Together well face the future with courage strength and wisdom. However in a registered mortgage both the lender and borrower are bound by certain legal provisions making it a safer financing alternative.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The list of providers is kept as up-to-date as possible. If you sign an incorrectly drafted mortgage in 2017 then put a second legal mortgage on your property in 2018 that second mortgage would actually become your first mortgage.

The Reminder July 26 August 1 2022 By Beacon Communications Issuu

News Out2learn

2

Free 10 Equity Sharing Agreement Samples In Ms Word Google Docs Apple Pages Pdf

2022 Upgrade Personal Loan Review

Free 10 Equity Sharing Agreement Samples In Ms Word Google Docs Apple Pages Pdf

Installment Loans In Milwaukee Wi Apply Online Now At Compacom

Advantages And Disadvantages Of Equitable Mortgage Mortgage Advantage Economical

2

2

Berwyn Township Assessor David Avila Posts Facebook

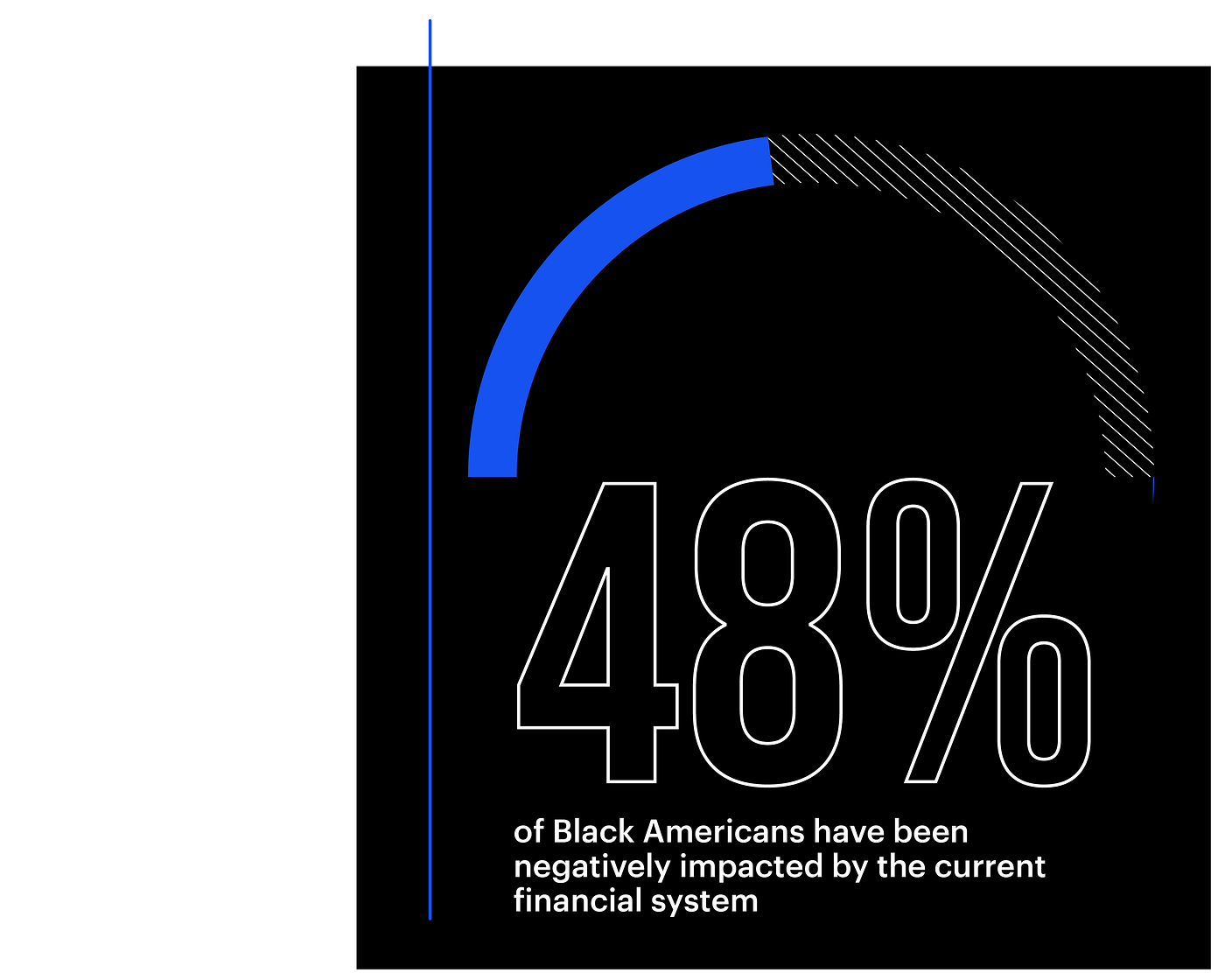

Coinbase Reports Black Americans Crypto By Coinbase The Coinbase Blog

2

Paradise Financing Solutions The Paradise Of Mortgages Disrupt Magazine

Rocky Sheehan Director Of Marketing Central Mountain Complex Equitable Advisors Linkedin

Free 10 Equity Sharing Agreement Samples In Ms Word Google Docs Apple Pages Pdf

Nikitra Bailey Senior Vice President Of Public Policy At The National Fair Housing Alliance National Fair Housing Alliance Linkedin